Brian Wesbury Weekly Outlook

24.01.2017 16:16 - First Trust Global Portfolios Limited

A memorable part of President Trump’s inaugural speech pointed to mothers and children trapped in poverty, rusted-out factories, a flawed school system, and crime and gangs and drugs. He described these problems as “American carnage” and stated emphatically that it “stops right here and stops right now.”

You’d have to go all the way back to President Carter’s “malaise” speech in July 1979, as gas lines were forming during the energy crisis, to find a sitting president so stark.

The difference is that Carter had already been president for 30 months, and in part, was taking responsibility. Donald Trump, on the other hand, is just taking office and is blaming it on his predecessors. No wonder some members of the establishment called it the worst inaugural speech ever.

All of this points to the oldest debate in political and economic history. The debate between wealth creation and redistribution, which is really a debate about whether government or markets control the “commanding heights” of the economy. One reason American politics are so divisive is that government has become so big. Those who benefit from it fight hard to keep it while those who want to slim it down have to fight even harder to make cuts.

We’re economists, so we want to focus on the “carnage” in the economy and what that means for investors. Part of this relates back to Frédéric Bastiat’s comments about what is “seen and unseen.”

The U.S. economy has grown at a regretfully slow 2.1% pace in the past seven-and-a-half years. Rising corporate profits have pushed the S&P 500 Index up 236%. The US has created 15.6 million jobs since the low point after the Panic of 2008. That’s the “seen” and it’s not really “carnage.” Companies have embraced new technologies, and employees and investors have benefited.

The “unseen” is what could have been. It’s the lost incomes, it’s the jobs “not” created, it’s the businesses not started. It’s the fact that it is harder to get ahead when the economy is not growing rapidly. Part of President Trump’s election victory was because he tapped into this pain.

Many economists explain this away by telling people that the economy can’t get better and that people ought to get used to slower growth. President Trump does not believe this.

And that’s why another portion of Trump’s speech gives us hope: “For too long, a small group in our nation’s Capital has reaped the rewards of government while the people have borne the cost. Washington flourished – but the people did not share in its wealth.”

This line points a finger at the lobbyists, lawyers, and bureaucrats, who have made a living by getting the government to dole out special favors for them or their clients.

And we think President Trump is on the right track. The “carnage” he sees is linked to these government-linked groups. Wherever markets have not been allowed to work freely the carnage is the worst. The more government involves itself in a market, the higher the prices and the lower the quality. Just look at many public schools in inner-cities.

That’s why we’re encouraged by reports that the Trump Administration will forcefully cut government spending and regulations, which should widen the zone where markets dominate.

Meanwhile, we’re discouraged by talk of tariffs. Trade laws could be better, but excessively high corporate tax rates and excessive regulation hurt. In addition, rapid productivity growth has undermined manufacturing job growth, just like happened in the farm sector over the past Century-plus.

Cutting government spending, reducing tax rates, and loosening regulations would not fix poverty or fill and polish rusted-out factories overnight. But they would reduce the amount of “American carnage” by boosting the creative side of creative destruction.

This material is issued by First Trust Global Portfolios Limited (“FTGP”) of 8 Angel Court, London, EC2R 7HJ.

FTGP is authorised and regulated by the UK Financial Conduct Authority (register no. 583261).

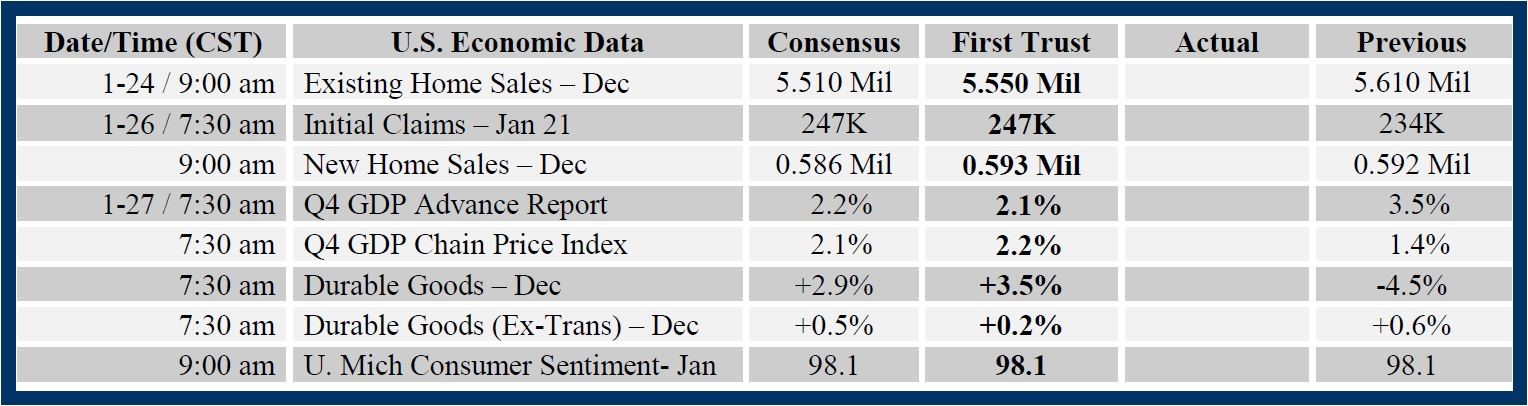

Consensus forecasts come from Bloomberg. This report was prepared by First Trust Advisors L. P., and reflects the current opinion of the authors. It is based upon sources and

data believed to be accurate and reliable. Opinions and forward looking statements expressed are subject to change without notice. This information does not constitute a

solicitation or an offer to buy or sell any security.