Brian Wesbury Weekly Outlook

18.10.2017 13:51 - First Trust Global Portfolios Limited

GPD Growth Looking Good (16 October 2017)

Next week, government statisticians will release the first estimate for third quarter real GDP growth. In spite of hurricanes, and continued negativity by conventional wisdom, we expect 2.8% growth.

If we’re right about the third quarter, real GDP will be up 2.2% from a year ago, which is exactly equal to the growth rate since the beginning of this recovery back in 2009. Looking at these four-quarter or eight-year growth rates, many people argue that the economy is still stuck in the mud.

But, we think looking in the rearview mirror misses positive developments. The economy hasn’t turned into a thoroughbred, but the plowing is easier. Regulations are being reduced, federal employment growth has slowed (even declined) and monetary policy remains extremely loose with some evidence that a more friendly business environment is lifting monetary velocity.

Early signs suggest solid near 3% growth in the fourth quarter as well. Put it all together and we may be seeing an acceleration toward the 2.5 – 3.0% range for underlying trend economic growth. Less government interference frees up entrepreneurship and productivity growth powered by new technology. Yes, the Fed is starting to normalize policy and, yes, Congress can’t seem to legislate itself out of a paper bag, but fiscal and monetary policy together are still pointing toward a good environment for growth.

Here’s how we get to 2.8% for Q3.

Consumption: Automakers reported car and light truck sales rose at a 7.6% annual rate in Q3. “Real” (inflation-adjusted) retail sales outside the auto sector grew at a 2% rate, and growth in services was moderate. Our models suggest real personal consumption of goods and services, combined, grew at a 2.3% annual rate in Q3, contributing 1.6 points to the real GDP growth rate (2.3 times the consumption share of GDP, which is 69%, equals 1.6).

Business Investment: Looks like another quarter of growth in overall business investment in Q3, with investment in equipment growing at about a 9% annual rate, investment in intellectual property growing at a trend rate of 5%, but with commercial constriction declining for the first time this year. Combined, it looks like they grew at a 4.9% rate, which should add 0.6 points to the real GDP growth. (4.9 times the 13% business investment share of GDP equals 0.6).

Home Building: Home building was likely hurt by the major storms in Q3 and should bounce back in the fourth quarter and remain on an upward trend for at least the next couple of years. In the meantime, we anticipate a drop at a 2.6% annual rate in Q3, which would subtract from the real GDP growth rate. (-2.6 times the home building share of GDP, which is 4%, equals -0.1).

Government: Military spending was up in Q3 but public construction projects were soft for the quarter. On net, we’re estimating that real government purchases were down at a 1.2% annual rate in Q3, which would subtract 0.2 points from the real GDP growth rate. (1.2 times the government purchase share of GDP, which is 17%, equals -0.2).

Trade: At this point, we only have trade data through August. Based on what we’ve seen so far, it looks like net exports should subtract 0.2 points from the real GDP growth rate in Q3.

Inventories: We have even less information on inventories than we do on trade, but what we have so far suggests companies are stocking shelves and showrooms at a much faster pace in Q3 than they were in Q2, which should add 1.1 points to the real GDP growth rate.

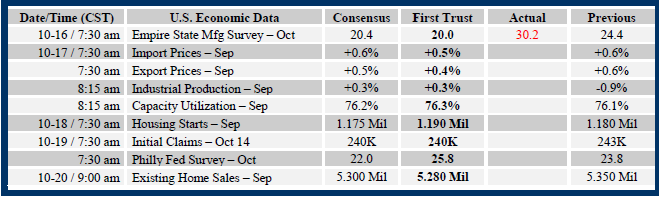

More data this week – on industrial production, durable goods, trade deficits, and inventories – could change our forecast. But, for now, we get an estimate of 2.8%. Not bad at all.