Relationship between risk and return

-unknown-Nothing ventured, nothing gained-unknown- as the saying goes. This maxim clearly expresses how closely intertwined risk and returns are. If you are seeking higher returns, you have to accept an increased risk of depreciation in value. For example, equity funds are expected to provide a much higher return over the long term than bond funds. However, the price fluctuations over the short and medium term are also markedly higher.

Unlike in everyday usage, in this context risk is completely neutral, given that prices can move up and down. Risk is understood here as the measurement of the upward and downward fluctuations in the price of an investment. The more intensive the swings, the higher the risk. The terms -unknown-risk-unknown-, -unknown-overall risk-unknown- and -unknown-volatility-unknown- all refer to the same statistical measure which expresses the historical fluctuations in the price of an investment as a percentage.

Relationships between risk, return, and investment horizon

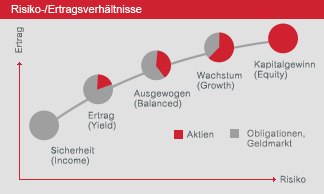

Certain fund categories are exposed to lower volatility and focus on regular distributions of income (from dividends or interest payments). Meanwhile, others entail higher risks and focus on price gains. The relationship between risk, return, and investment horizon is exceptionally important in the investment world, and is often the subject of studies. The findings can be summed up as follows:

- The more risk an investor takes on, the more returns they can expect over a corresponding investment horizon. To put this another way, the more returns an investor wants, the higher the risk they have to be prepared to take on.

- The higher the risk taken on, the longer the investment horizon should be. And the longer the investment horizon, the more risk an investor can take on.

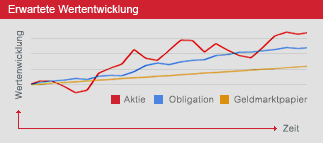

- As a rule, equities entail more risk than bonds, and bonds more risk than money market instruments. On the other hand, equities generate higher returns over the long term than bonds, and bonds higher returns than money market instruments.

In the broadest sense, the return is understood as being -unknown-what an investment yields-unknown-. This can be interest or dividend income, or income from price gains.

The return of an investment fund also always has to be viewed against the backdrop of the prevailing market environment, which it cannot distance itself from.

Returns

Investment funds offer investors returns in line with the market.

Security

The broad diversification of investments and professional fund management allow investors to spread risks in the asset class they choose.

Liquidity

Units of investment funds can be returned to the fund provider at any time for redemption at the current value and thus converted into liquid assets.