Brian Wesbury Weekly Outlook

25.07.2017 14:53 - First Trust Global Portfolios Limited

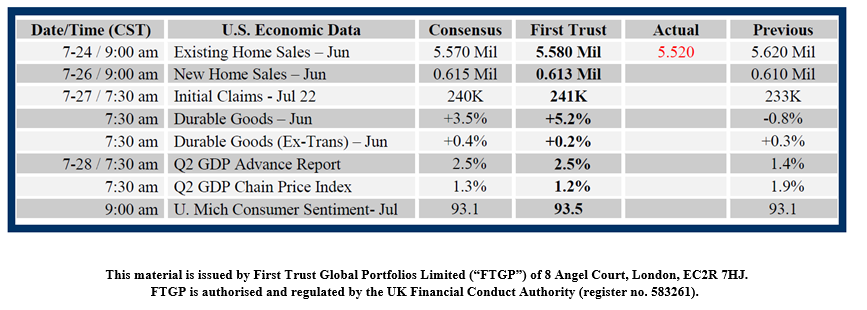

Since the start of the economic recovery in mid-2009, real GDP has grown at an average annual rate of 2.1%. The second quarter of this year doesn’t look much different. Our calculations suggest real GDP grew at a 2.5% annual rate in Q2, exactly the same as the consensus forecast.

That’s an acceleration from the 1.4% pace in Q1 and we expect better growth ahead. But consistently better growth is going to take more than lots of talk from Washington, DC. Instead, it’s going to take some concrete steps, like less regulation, lower tax rates, less spending, and a more free-market approach to health care.

Here’s how we get to 2.5% for Q2.

Consumption: Automakers reported car and light truck sales dropped at a 12.3% annual rate in Q2. “Real” (inflation-adjusted) retail sales outside the auto sector grew at a 1.2% rate, but growth in services was strong, in part due to a rebound in (seasonally-adjusted) utility output after unusually mild weather in January and February. Our models suggest real personal consumption of goods and services, combined, grew at a 2.9% annual rate in Q2, contributing 2.0 points to the real GDP growth rate (2.9 times the consumption share of GDP, which is 69%, equals 2.0).

Business Investment: After clicking on all cylinders in Q1, business investment grew more modestly in Q2. Investment in business equipment and intellectual property both grew at about a 4% rate, but commercial construction fell at about a 7% pace. Combined, it looks like they grew at a 1.7% rate, which should add 0.2 points to the real GDP growth. (1.7 times the 13% business investment share of GDP equals 0.2).

Home Building: While boosting utilities in Q2, the return to more normal weather patterns dampened home construction. Home building looks like it grew in Q2, but at a 2.5% annualized pace rather than the 12.9% pace in Q1. The trend is somewhere between the two and we expect continued growth in this sector even if mortgage rates rise, as more jobs and faster wage growth will lead to more demand for housing. In the meantime, a 2.5% growth rate will add 0.1 points to the real GDP growth rate. (2.5 times the home building share of GDP, which is 4%, equals 0.1).

Government: Both military spending and public construction projects look close to trend in Q2. On net, we’re estimating that real government purchases were up at a 1.4% annual rate in Q2, which would add 0.2 points to the real GDP growth rate. (1.4 times the government purchase share of GDP, which is 17%, equals 0.2).

Trade: At this point, we only have trade data through May. Based on what we’ve seen so far, it looks like net exports should subtract 0.3 points from the real GDP growth rate in Q2.

Inventories: We have even less information on inventories than we do on trade, but what we have so far suggests companies are stocking shelves and showrooms at a slightly faster pace in Q2 than they were in Q1, which should add 0.3 points to the real GDP growth rate.

Keep in mind that there are reports on durable goods as well as international trade and inventories the day before the GDP release and those figures could change our forecast as well. But, for the time being, you can put it all together, and get an estimate of 2.5% for Q2.

No one should be excited or dismayed by this report. It is the epitome of the Plow Horse pace of growth we’ve had for the past eight years. Hopefully, Washington will now get its act together and make this one of the last Plow Horse reports we have to see.