Brian Wesbury Weekly Outlook

02.03.2020 12:53 - First Trust Global Portfolios Limited

One of the worst bipartisan policy decisions in the past generation was the aggressive government push in the 1990s and 2000s to promote homeownership, beyond what the free market could handle. Policymakers encouraged Fannie Mae and Freddie Mac to gobble up lots of subprime debt, in turn boosting lending to borrowers who couldn’t handle their loans.

But now a bizarre idea is making the rounds that, looking back on it, maybe there wasn’t a housing bubble at all!

The theory is that home prices are already up substantially from where they were at the prior peak during the “bubble,” so maybe those “bubble” prices were not that high after all. Compared to the prior peak in 2007, the national Case-Shiller index is up 15%, while the FHFA index, which measures the prices of homes financed with conforming mortgages, is up 24%.

But a great deal has changed since the prior peak, which makes it much easier to justify the higher prices of today. To assess the “fair value” of homes, we use a Price-to-Rent (P/R) ratio, which compares the asset value of all owner-occupied homes (calculated by the Federal Reserve) to the “imputed” rental value of those homes (what owners could fetch for their homes if they rented them, as calculated by the Commerce Department). Think of it like a P/E ratio: the price of all owner-occupied homes, compared to what those same homes would earn if they were rented.

For the past 40 years, the median P/R ratio is 16.0. At the peak of the housing bubble, the ratio hit a record-high of 21.4. In other words, prices were 34% above fair value. During the housing bust, the ratio plunged to 14.1, meaning national average home prices were 12% lower than you’d expect given rents. Temporarily, that made sense: prices had to get below fair value to clear the excess inventory.

Today, the P/R ratio stands at 17.0, which means home prices are 6% above their long-term average relative to rents. That’s well within the normal historical range, and no reason to sell.

Comparing home values to replacement costs shows a similar pattern. That median ratio in the past forty years has been 1.58, compared with 1.59 today (almost exactly fair value) and 1.94 at the peak in 2005 (23% above fair value).

Either way you slice it, bubble era home prices really were far in excess of what you’d expect given rents and replacement costs, while prices today look reasonable.

We expect home prices to keep moving higher, but not as fast as in the last few years. Meanwhile, the climb in average home prices will diverge at the local level. Due to the limit on state and local tax deductions, expect high tax states to show flat home prices (on average), while low-tax states experience stronger price gains.

One of the reasons we remain optimistic about economic growth in general is the continued recovery in home building.

Housing starts bottomed in 2009, when builders began just 554,000 homes, 73% below the 2.073 million pace at the peak of the housing boom in 2005. Since 2010, the number of housing starts has increased in every year, hitting 1.300 million in 2019.

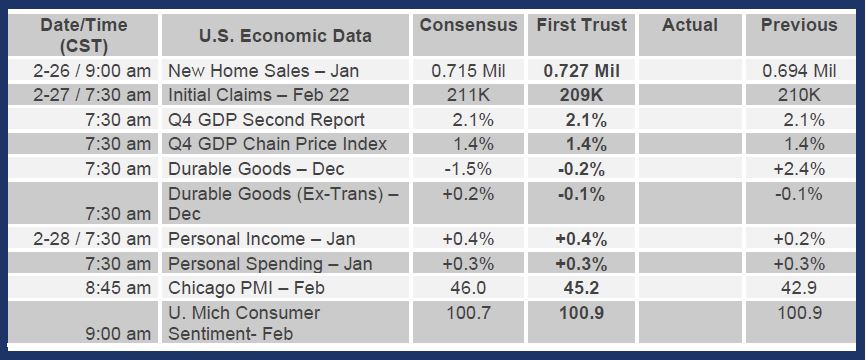

Starts have been much higher in recent months due to the unusually mild winter weather throughout much of the country. And while we may see a pullback in the coming months as weather patterns return to normal, we anticipate at least a few more years of gains in home building. Given population growth and scrappage (knock downs, fires, floods, hurricanes, tornadoes…etc), builders have simply started too few homes since the bust. Now it looks like they need to overshoot to make up for lost time. In turn, expect new home sales to follow starts higher.